The 2022 Employee Retention Credit is a tax incentive program designed to help employers retain their workforce during these challenging times. The credit provides financial relief to eligible employers by offsetting a portion of their qualified employee wages and health care expenses.

To be eligible for the credit, employers must meet certain qualifications and follow specific guidelines set forth by the IRS. One of the key qualifications is that the employer must have experienced a significant decline in gross receipts. This decline can be measured on a quarterly basis compared to the same quarter in 2019, or on an annual basis compared to 2019. The specific guidelines for determining the decline in gross receipts are outlined in the IRS guidance.

In addition to the decline in gross receipts, employers must also meet other eligibility requirements. These include being in operation during the calendar year 2022 and not being a government entity or small tax-exempt organization. Employers who have received certain other COVID-19 relief credits, such as the Paid Sick and Family Leave Credits, may be disqualified from claiming the Employee Retention Credit.

The credit is meant to incentivize employers to retain their employees and continue hiring new ones. By offering financial relief through tax credits, the program aims to reduce the financial burden on employers and encourage them to invest in their workforce. This not only helps individual employees by ensuring job security, but it also contributes to the overall economic recovery.

What is the Employee Retention Credit?

The Employee Retention Credit is a tax incentive program designed to provide financial relief and incentivize employers to retain their workforce amidst economic challenges. It was introduced as part of the COVID-19 relief legislation and has been extended into 2022. The program allows eligible employers to claim a tax credit against qualified wages and expenses incurred while keeping employees on the payroll.

To qualify for the Employee Retention Credit, employers must meet certain eligibility guidelines. They should have experienced a significant decline in gross receipts or have faced a full or partial suspension of business operations due to government orders. Additionally, qualified employers can also claim the credit if they have hired new employees during the specified period.

The Employee Retention Credit serves as an important benefit for employers as it provides them with a tax credit to offset their tax liability. This credit can help alleviate the financial burden and encourage employers to invest in retaining their workforce. By incentivizing employee retention, the program aims to support businesses and promote stability in the job market.

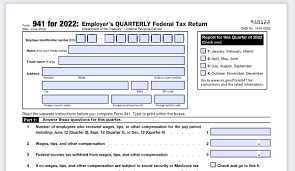

To apply for the Employee Retention Credit, employers need to file Form 941, the Employer's Quarterly Federal Tax Return. The credit amount is calculated based on qualified wages and expenses paid during the eligible period. It's essential for employers to keep track of their eligible expenses and ensure compliance with the program's guidelines.

In summary, the Employee Retention Credit is a tax incentive program that provides financial relief and encourages employers to retain their workforce. By offering a tax credit against qualified wages and expenses, the program aims to incentivize employee retention, support businesses, and promote stability in the job market. Eligible employers can apply for the credit by filing Form 941 and must meet certain eligibility criteria.

Overview of the credit

The 2022 Employee Retention Credit is a tax relief program designed to incentivize employers to retain their workforce and hire new employees by providing a tax credit for qualified expenses. The credit is intended to provide financial support to employers who have been affected by the ongoing COVID-19 pandemic.

To be eligible for the credit, employers must meet certain qualifications and guidelines set forth by the IRS. These qualifications include having a significant decline in gross receipts or being subject to a government order that fully or partially suspended their business operations.

The credit can be applied against the employer's share of social security tax and can potentially result in significant tax savings. Qualified expenses that can be used to calculate the credit include wages, certain health care expenses, and qualified wages paid to new employees.

Employers can apply for the credit by filing Form 941, the employer's quarterly tax return, with the IRS. It's important for employers to keep accurate records and documentation of their eligible expenses and payments in order to claim the credit.

The Employee Retention Credit serves as an important incentive for employers to not only retain their existing workforce but also to hire new employees. By providing financial relief and tax savings, the credit aims to support businesses during these challenging times and help stimulate economic recovery.

Qualifications for the Employee Retention Credit

The Employee Retention Credit (ERC) is a tax credit designed to incentivize qualified employers to retain their employees during the COVID-19 pandemic. This credit provides financial relief and serves as an incentive for employers to keep their workforce intact.

To qualify for the ERC in 2022, an employer must meet certain guidelines and eligibility criteria. First, the employer must be qualified, which means they must have experienced either a full or partial suspension of their operations due to government orders or have seen a significant decline in gross receipts.

Furthermore, to be eligible for the credit, the employer must satisfy certain employment qualifications. The guidelines state that the business must have employed an average of 500 or fewer full-time employees during 2019. However, for 2022, this threshold has increased to 1,500 employees.

In order to claim the credit, the employer must demonstrate that they have retained their workforce. Specifically, they must show that they have not reduced their employee headcount or wages by a certain percentage. This helps to ensure that the credit is truly benefiting and incentivizing employers to keep their employees on payroll.

It's important to note that the ERC can be claimed in addition to other tax credits and incentives, such as the Work Opportunity Tax Credit (WOTC) for hiring certain targeted groups. By combining these benefits, employers can maximize their tax savings and support their business operations during these challenging times.

Overall, the Employee Retention Credit serves as a valuable tool for employers to offset the financial burden of retaining their workforce. This credit not only provides relief in the form of reduced tax liability but also incentivizes employers to prioritize employee retention, benefiting both businesses and their employees.

Eligibility requirements for businesses

Businesses that want to take advantage of the 2022 Employee Retention Credit must meet specific eligibility requirements set forth by the program guidelines. The credit is intended to provide relief to businesses that have experienced economic hardship due to the COVID-19 pandemic and incentivize them to retain and hire employees.

To qualify for the credit, businesses must have been in operation during the eligibility period, which spans from January 1, 2022, to December 31, 2022. Additionally, businesses must demonstrate a decline in gross receipts or a full or partial suspension of operations due to government orders related to COVID-19.

The credit is calculated based on qualified wages and certain health plan expenses paid to employees. Qualified wages include wages paid to employees who are not providing services due to a full or partial suspension of business operations or a significant decline in gross receipts. Health plan expenses can also be included in the calculation.

Businesses can apply for the credit by filing Form 941, Employer's Quarterly Federal Tax Return, for each quarter in which they are eligible. The credit is then taken on the business's employment tax return. It's important to keep detailed records and documentation to support the eligibility and amount of the credit claimed.

The 2022 Employee Retention Credit provides a valuable incentive for businesses to retain and hire employees during a time of economic uncertainty. By meeting the eligibility requirements and properly applying for the credit, businesses can benefit from tax relief and potentially improve their financial stability.

Size and impact criteria

Eligibility for the 2022 Employee Retention Credit (ERC) is determined based on certain size and impact criteria. These criteria are designed to assess the workforce and program of an employer to determine their eligibility for the credit.

To qualify for the ERC, an employer must have experienced a significant decline in gross receipts or have been fully or partially suspended due to government orders. The size criteria require that the employer's average annual gross receipts for the 2019 or 2020 tax years not exceed $1 billion. This ensures that the credit is targeted towards smaller businesses that may have been most affected by the pandemic.

In addition to the size criteria, there are guidelines related to the number of full-time equivalent employees. Eligible employers with an average of 500 or fewer full-time employees in 2019 or 2020 can claim the credit for wages paid to all employees, whereas larger employers can only claim the credit for wages paid to employees who are not providing services due to the suspension of operations or decline in gross receipts.

The 2022 Employee Retention Credit provides a valuable tax benefit to eligible employers who have suffered financially due to the pandemic. It serves as an incentive to retain and hire employees, as well as to continue operating during these challenging times. By providing relief in the form of a tax credit, the program aims to incentivize employers to invest in their workforce and stimulate economic recovery.

Qualified expenses that can be used to calculate the credit include qualified wages and certain health care expenses. The credit amount is calculated based on a percentage of the qualified wages paid to eligible employees during the eligible period. Employers should consult the specific guidelines and requirements to ensure they meet all qualifications for the credit.

Partial suspension of operations

When it comes to qualifying for the 2022 Employee Retention Credit program, a partial suspension of operations can play a crucial role. This eligibility criterion pertains to instances where expenses and workforce have been impacted due to government guidelines, restrictions, or orders.

The goal of this provision is to incentivize employers to retain their qualified workforce by providing a tax credit as an incentive. It recognizes that certain industries and businesses may have been especially affected by the pandemic and need additional support to maintain their operations.

To qualify for the credit, an employer must demonstrate that they have experienced a partial suspension of operations. This means that they were not completely shut down, but their operations were significantly limited or altered due to COVID-19 related measures.

An employer may have faced a partial suspension if they had to reduce their business hours, limit customer capacity, or implement social distancing protocols that resulted in reduced customer traffic. It could also include situations where supply chain disruptions affected the ability to operate or government orders forced the closure of specific departments or locations.

If an employer qualifies for the credit based on a partial suspension of operations, they can claim a benefit of up to $7,000 per employee per quarter. This credit can be used to offset the employer's share of Medicare taxes or applied against other employment-related taxes.

The 2022 Employee Retention Credit is designed to provide much-needed relief to qualified employers and encourage the retention and hiring of employees. By recognizing the challenges faced by businesses during the pandemic, this program offers a valuable tax incentive that can help alleviate some of the financial burdens and promote economic recovery.

Eligible wages and compensation

Hiring and retaining qualified employees is crucial for the success of any business. Fortunately, the 2022 Employee Retention Credit (ERC) provides a valuable incentive for employers to keep their workforce intact.

Under the program's guidelines, eligible wages and compensation are key factors in determining an employer's eligibility for the tax credit.

The credit applies to certain wages and compensation paid between January 1, 2022, and December 31, 2022.

To qualify, the wages and compensation must meet specific criteria:

- The wages and compensation must be paid to employees who have been retained by the employer during the qualifying period.

- The employees must not be family members or related parties to the employer.

- The wages and compensation must fall within the designated eligible wage subsidy period.

- The employer must have experienced a significant decline in gross receipts or been subject to a full or partial suspension of business operations due to government orders.

It's important to note that the credit can only be claimed for qualified wages and compensation that are not already used to claim other COVID-19 relief programs, such as the Paycheck Protection Program (PPP) or the Families First Coronavirus Response Act (FFCRA) tax credits.

Employers who meet the eligibility criteria can apply for the ERC by filing the appropriate forms with the Internal Revenue Service (IRS).

The benefit of the ERC is that it provides a direct tax credit against the employer's share of Social Security tax, reducing the overall tax liability.

By taking advantage of the 2022 Employee Retention Credit, employers can offset wages and compensation expenses while providing much-needed financial relief during this challenging time.

How to determine qualified wages

When it comes to determining qualified wages for the 2022 Employee Retention Credit program, employers need to follow certain guidelines.

The purpose of the program is to incentivize employers to retain their workforce by providing a tax credit. To qualify for this credit, an employer must meet a set of qualifications and determine the qualified wages they can claim.

Qualified wages refer to the amount an employer paid to an eligible employee during the eligibility period. These wages can include both cash compensation and certain health plan expenses. However, there are limits and exclusions on the types of wages that can be considered qualified.

It is important for an employer to carefully review the guidelines provided by the IRS to ensure they are properly determining and calculating the qualified wages. They must ensure that the wages meet the requirements outlined in the program to maximize the benefit they can receive.

Employers can use the IRS Form 941, Employer's Quarterly Federal Tax Return, to calculate and report the qualified wages. The form provides specific instructions on how to determine the amount eligible for the retention credit.

By properly determining qualified wages, employers can take advantage of the 2022 Employee Retention Credit to offset their eligible employment taxes and receive much needed relief and support during these challenging times.

Exclusions for certain wages

The 2022 Employee Retention Credit program offers a valuable incentive for employers to retain and hire employees by providing a tax credit for qualified wages. However, there are certain exclusions and limitations that apply to certain types of wages.

First, it's important to note that the Employee Retention Credit is not available for wages that are already being used to claim other tax benefits, such as the Work Opportunity Tax Credit or the Paid Family and Medical Leave Credit. This ensures that employers do not receive multiple benefits for the same wages.

In addition, wages paid to relatives or family members are generally excluded from qualifying for the Employee Retention Credit. This is to prevent abuse of the program by incentivizing employers to hire or retain family members solely for the purpose of claiming the credit.

Furthermore, wages paid to 50% or more owners of the company, including their spouses and children, are also excluded from the credit. This exclusion ensures that the credit is being used to benefit the broader workforce and not just the owners themselves.

Finally, any wages that are reimbursed through certain government programs or grants, such as the Paycheck Protection Program (PPP) or the Restaurant Revitalization Fund (RRF), are also excluded from eligibility for the Employee Retention Credit. This prevents "double-dipping" and ensures that employers are not receiving duplicate relief for the same expenses.

Understanding the exclusions for certain wages is essential for employers looking to take advantage of the 2022 Employee Retention Credit. By following the guidelines and ensuring that qualified wages are used, employers can benefit from this valuable tax credit while also supporting their employees and business during these challenging times.

Internal Revenue Service (IRS) guidance

The Internal Revenue Service (IRS) provides guidelines and regulations for the implementation and qualification of the 2022 Employee Retention Credit. This tax credit is designed to provide financial relief and incentives to employers who have experienced economic hardship due to the COVID-19 pandemic and have made efforts to retain their employees.

To qualify for the credit, employers must meet specific criteria outlined by the IRS. This includes demonstrating a decline in gross receipts or experiencing a full or partial suspension of business operations due to government orders.

Employers can apply the credit to qualified wages and health care expenses that they have paid to their employees. These qualified expenses may include wages, healthcare benefits, and certain other employee benefits.

The Employee Retention Credit program serves as an incentive for employers to retain their workforce and encourage the hiring of new employees. By providing financial benefits, the program aims to support businesses during challenging economic times and incentivize them to maintain their workforce despite any detrimental financial impact from the pandemic.

The IRS guidance for the 2022 Employee Retention Credit provides detailed instructions on how employers can calculate and claim the credit, as well as the specific qualifications and eligibility requirements that must be met. Employers are encouraged to review this guidance and consult with their tax advisors to ensure compliance with all applicable tax laws and regulations.

Interpretation of qualifications

The 2022 Employee Retention Credit (ERC) program is a tax relief incentive aimed at incentivizing employers to retain their workforce by providing a credit against certain qualified wages and healthcare expenses. To benefit from this program, employers must meet specific qualifications and adhere to certain guidelines.

First and foremost, the program is available to eligible employers who experienced a significant decline in gross receipts or were subject to a full or partial suspension of operations due to governmental orders related to the COVID-19 pandemic. This qualification ensures that the credit is targeted towards businesses that have been most economically impacted.

Employers who meet the qualifications can claim the credit for a specified percentage of qualified wages and healthcare expenses paid to their employees. Qualified wages are those paid to employees during the period when the business experienced a decline in gross receipts or a suspension of operations. This credit can be used to offset the employer's share of Medicare tax as well.

It's important to note that employers cannot claim the ERC on wages or healthcare expenses that were already used to claim other COVID-19 related tax credits such as the Paid Sick Leave Credit or the Paid Family Leave Credit. However, they can claim the ERC in addition to the credit for qualified health plan expenses.

To apply for the credit, employers must use Form 941, the employer's quarterly federal tax return. They will need to indicate the total qualified wages and healthcare expenses paid and subtract any previously claimed credits. This information will be used to calculate the credit amount.

Overall, the 2022 Employee Retention Credit serves as a valuable benefit for employers, providing financial relief and encouraging the retention of employees during challenging times. By meeting the qualifications and following the guidelines, employers can take advantage of this taxation incentive and support the stability of their workforce.

Documentation requirements

To qualify for the 2022 Employee Retention Credit, employers must provide certain documentation to support their eligibility for the program. This documentation includes proof of qualified wages and proof of a decline in gross receipts. These requirements are in place to ensure that the relief is provided to employers who meet the specific qualifications.

Employers should maintain accurate records of all qualified wages and related expenses. This documentation should include payroll records, cancelled checks, and other documentation that supports the amount of qualified wages paid to employees. In addition to proving the amount of qualified wages, employers must also provide documentation that shows a decline in gross receipts.

The guidelines for documenting a decline in gross receipts depend on the size of the employer. If the employer had less than $5 million in gross receipts in 2021, they can use a quarter-over-quarter comparison to show a decline. For employers with more than $5 million in gross receipts, they must use a year-over-year comparison. Documentation for this decline can include financial statements, sales records, or other relevant documentation.

Documentation is a crucial part of the application process for the Employee Retention Credit. It provides the necessary evidence to support an employer's claim and ensures that the credit is being used as intended - as an incentive for employers to retain their workforce during these challenging times. By maintaining accurate and thorough documentation, employers can benefit from this tax credit and provide relief to their business.

Claiming the Employee Retention Credit

The Employee Retention Credit is a beneficial relief program introduced in 2022 to incentivize employers to invest in hiring and retention of qualified employees. To claim the credit, employers need to submit an application and meet certain eligibility qualifications.

Employers can claim the credit for wages paid to employees who meet the guidelines. The credit can be used to offset the employer's share of social security tax, or it can be refunded if the credit exceeds the total tax liability. This serves as a valuable incentive for employers to maintain a strong workforce.

To qualify for the credit, employers must have experienced a significant decline in gross receipts or have been subject to a full or partial suspension of operations due to government orders. The credit is calculated based on a percentage of qualified wages paid to eligible employees during the applicable period.

The credit can be claimed by eligible employers on a quarterly basis, allowing them to recoup a portion of the qualified wages paid during that period. This can provide much-needed financial support to businesses who have been impacted by the effects of the ongoing pandemic.

In conclusion, the Employee Retention Credit is a valuable program for employers to offset some of the taxation expenses associated with maintaining a qualified workforce. By providing a financial incentive for hiring and retention, the credit aims to support businesses and stimulate economic recovery.

Calculating the credit amount

The calculation of the Employee Retention Credit for taxation year 2022 is based on several factors related to the employer's hiring and retention practices. The credit is designed as an incentive for employers to retain their workforce and incentivize hiring during challenging times. To determine the credit amount, employers must consider their eligibility and adhere to specific guidelines set forth by the program.

The credit is calculated as a percentage of qualified wages, which includes the wages and certain health plan expenses paid to eligible employees. However, there are certain limitations on the amount of wages that can be considered in the calculation. The credit is capped at a maximum amount per employee per quarter, providing relief to employers while controlling the overall cost of the program.

To calculate the credit, employers need to determine the number of qualified employees they have on a quarterly basis. Qualified employees are those who meet specific eligibility criteria, such as being employed during a period affected by the COVID-19 pandemic, experiencing a significant decline in gross receipts, or being subject to a full or partial suspension of business operations due to government orders.

Once the number of qualified employees is determined, employers can calculate the credit amount by multiplying the qualified wages by the credit rate for each employee. The credit rate varies depending on the quarter and is subject to change based on legislation and updates from the tax authorities. It's important for employers to stay informed about any changes to ensure accurate calculation and application of the credit.

Overall, the Employee Retention Credit for taxation year 2022 provides employers with a significant benefit in terms of tax relief and cost savings. By understanding the guidelines and properly calculating the credit amount, employers can take advantage of this program to retain their workforce, manage expenses, and navigate the economic challenges brought on by the COVID-19 pandemic.

Maximum credit per employee

Under the 2022 Employee Retention Credit (ERC) program, employers can claim a tax credit for a maximum of $7,000 per employee per quarter. This credit is designed to incentivize employers to retain their workforce and continue to hire amid the challenges of the COVID-19 pandemic.

The guidelines for eligibility and qualifications for the ERC are important for employers to understand. To qualify for the credit, an employer must meet certain criteria, including experiencing a significant decline in gross receipts or being subject to a government order that fully or partially suspended their operations.

The maximum credit per employee is calculated based on qualified wages and health plan expenses paid by the employer. Qualified wages include both wages paid to employees and certain qualified health plan expenses. The credit is equal to 70% of qualified wages and health plan expenses, up to the maximum of $7,000 per employee per quarter.

By providing this financial benefit, the 2022 ERC aims to support employers in retaining their employees and promoting job stability during these challenging times. The credit can help offset the financial burden of hiring and retaining employees, ultimately benefiting both employers and their workforce.

Employers who wish to claim the 2022 ERC must apply through the appropriate tax authorities, submitting the necessary documents and information. It is important for employers to familiarize themselves with the application process and ensure they meet all the qualifications to receive the credit.

Interaction with other COVID-19 relief programs

The 2022 Employee Retention Credit program offers a tax benefit to eligible employers who have retained their workforce during the COVID-19 pandemic. This credit is designed to incentivize employers to keep their qualified employees on payroll by providing a tax credit based on certain wages and qualified employee expenses.

It's important to note that the 2022 Employee Retention Credit program can be used in conjunction with other COVID-19 relief programs. Employers who meet the eligibility criteria for multiple relief programs can take advantage of the benefits offered by each program separately.

For example, an employer who qualifies for both the Paycheck Protection Program (PPP) and the Employee Retention Credit program can receive benefits from both programs simultaneously. The PPP loan can be used to cover certain payroll and employee benefit costs, while the Employee Retention Credit can be claimed as a tax credit on qualified wages paid to eligible employees.

Additionally, employers can also coordinate the use of the Employee Retention Credit with other COVID-19 tax incentives, such as the Employer Credit for Paid Family and Medical Leave or the Work Opportunity Tax Credit. By utilizing multiple relief programs and tax incentives, employers can maximize the benefits they receive and better navigate the financial challenges brought on by the pandemic.

However, it's important for employers to carefully review the guidelines and requirements of each program to ensure compliance with all applicable guidelines. Proper documentation and record-keeping are crucial to support the eligibility for and use of these relief programs.

Filing requirements

Qualifying employers who wish to claim the 2022 Employee Retention Credit must adhere to specific filing requirements to ensure they receive the full benefit of this tax incentive.

Employers must accurately complete and submit an application to demonstrate their eligibility for the credit. The application should outline the qualified employee wages and eligible expenses that the employer is seeking credit for. It is essential to include supporting documentation, such as payroll records, to substantiate the claimed expenses.

Employers should familiarize themselves with the guidelines and eligibility criteria outlined by the IRS for the 2022 Employee Retention Credit program. This will help ensure the proper documentation and information needed for filing. Employers can also consult with a tax professional to navigate the filing process smoothly.

When filing for the credit, employers must accurately report the qualified wages paid to eligible employees during the specified time period. This includes any eligible health plan expenses. Accurate and detailed reporting is crucial to avoid any delays or complications in the processing of the credit.

Failure to meet the filing requirements, provide adequate supporting documentation, or accurately report eligible expenses may result in the employer being denied the Employee Retention Credit. Therefore, it is important for employers to diligently comply with all filing requirements and guidelines to ensure they receive the full benefit of this tax relief program and to incentivize the hiring and retention of their workforce.

Forms and deadlines

The 2022 Employee Retention Credit program provides a valuable benefit to employers looking for tax relief and incentives to retain and hire employees. To take advantage of this credit, employers need to understand the forms and deadlines involved.

Employers who meet the eligibility qualifications for the 2022 Employee Retention Credit should use Form 941, the Employer's Quarterly Federal Tax Return, to claim the credit. This form should be submitted to the IRS on a quarterly basis, along with the employer's regular payroll tax returns.

There are specific guidelines and deadlines for submitting Form 941 and claiming the Employee Retention Credit. Employers must file this form by the last day of the month following the end of each calendar quarter. For example, the deadline for filing the first-quarter Form 941 and claiming the credit is April 30, 2023.

Employers should ensure that they carefully complete Form 941, including all necessary information and calculations, to accurately claim the Employee Retention Credit. It is important to review the IRS instructions for this form and seek professional assistance if needed, to avoid any errors or delays in receiving the credit.

Supporting documents

When applying for the 2022 Employee Retention Credit, employers will need to provide various supporting documents to prove their eligibility and to support their claim for the tax credit.

Documentation of eligible expenses: Employers should maintain records and receipts for qualified wages, healthcare plan expenses, and group healthcare plan expenses paid during the eligible periods. This documentation will serve as evidence of the expenses incurred and will be necessary to calculate the credit amount.

Proof of eligibility: Employers will need to provide documentation to confirm their eligibility for the Employee Retention Credit. This may include evidence of a significant decline in gross receipts or a full or partial suspension of business operations due to the COVID-19 pandemic.

Employee-related documents: Employers should keep records of the number of full-time and part-time employees and their respective hours and wages during the eligible periods. This information will be used to determine the credit amount and to verify that the employees meet the eligibility requirements.

Payroll tax filings: Employers should provide copies of their quarterly payroll tax filings, such as the Form 941, to demonstrate the amount of taxes withheld and the total amount of qualified wages during the eligible periods.

Bank statements and financial statements: Employers may be required to provide bank statements and financial statements to verify their financial situation and support their claim for the Employee Retention Credit. These documents can help demonstrate the impact of the COVID-19 pandemic on their business and the need for financial relief.

Other relevant documentation: Depending on the specific circumstances, employers may also need to provide additional supporting documents, such as lease agreements, utility bills, or invoices, to substantiate their claim for the tax credit.

It is important for employers to keep detailed and accurate records of all the necessary supporting documents to ensure a smooth application process and to meet the guidelines and requirements of the Employee Retention Credit program. These documents are essential for the IRS to verify the eligibility and the amount of credit claimed, and they also serve as a benefit to employers by demonstrating compliance with the program and providing evidence of the incentivize hiring and retention of employees.

Amending prior tax returns

As part of the 2022 Employee Retention Credit program, employers have the incentive to amend their prior tax returns to take advantage of the tax benefits provided. This means that employers can retroactively claim the credit for eligible employees who were previously not included in the calculation.

By amending prior tax returns to include eligible employees, employers can potentially reduce their overall tax liability and take advantage of the tax relief provided by the program. This can be particularly beneficial for employers who have seen a decrease in revenue and are looking for ways to minimize their tax burden.

To be eligible for amending prior tax returns, employers need to meet the qualifications and guidelines set forth by the Employee Retention Credit program. This includes having a qualified workforce, meeting the employer eligibility requirements, and ensuring that the eligible employees meet the criteria for the credit.

Amending prior tax returns to claim the Employee Retention Credit can provide significant financial relief for employers, especially those who have been heavily impacted by the COVID-19 pandemic. The program aims to incentivize employers to retain and hire employees by offering a tax credit that can be used to offset wage and employment taxes.

It is important for employers to carefully review the eligibility requirements and guidelines for amending prior tax returns to ensure that they meet all the necessary criteria. Employers may need to consult with a tax professional or refer to the official IRS guidelines to properly complete the application process and claim the credit.

Process for claiming retroactive credits

To incentivize employers to retain and hire qualified employees, the 2022 Employee Retention Credit program offers a tax relief benefit. Eligible employers can claim retroactive credits for certain expenses related to their workforce. In order to apply for these credits, employers need to follow a specific process.

The first step in claiming retroactive credits is to determine the eligibility of the employer and the employees. The guidelines set forth by the program outline the criteria for qualifying employers, such as having experienced a significant decline in revenue, and qualifying employees, such as being retained or newly hired during the specified time period.

Once eligibility has been established, employers can start gathering the necessary documentation to support their retroactive credit claims. This includes providing evidence of the qualified wages paid to the eligible employees, as well as any other expenses that may be eligible for the credit, such as certain healthcare expenses or employer-sponsored retirement plan contributions.

The next step is to calculate the amount of credit that can be claimed for each eligible employee. This involves determining the qualified wages paid during the applicable time period, which may have different caps depending on the size of the employer. The credit can be claimed for up to a specified percentage of the qualified wages paid, which is determined by the program guidelines.

Once the credit amount has been calculated, employers can then include it on their tax return as a credit against their payroll tax liabilities. The specific forms and procedures for claiming the credit will vary depending on the employer's tax filing status and the applicable tax year.

It is important for employers to familiarize themselves with the program's requirements and deadlines to ensure that they are able to claim the retroactive credits in a timely manner. By following the proper process and providing accurate documentation, employers can take advantage of the 2022 Employee Retention Credit to support their business operations and provide financial relief.

Limitations and timeframes

The 2022 Employee Retention Credit program has certain limitations and timeframes that employers must adhere to in order to be eligible and qualify for the tax credit. These guidelines are put in place to ensure that the program is used appropriately and effectively.

First and foremost, the employer must meet the eligibility requirements in order to participate in the program. They must have experienced a significant decline in gross receipts or have been subject to a full or partial suspension of operations due to government orders related to COVID-19. This qualification ensures that the credit is targeted towards those businesses that have been most impacted by the pandemic.

The program has a designated timeframe for qualified wages and qualified expenses that employers can claim for the retention credit. The qualifying wages and expenses must be incurred between January 1, 2022, and December 31, 2022. This timeframe provides a clear boundary for employers to track their expenses and ensures that the credit is applicable to the specific year.

It's important to note that the retention credit is not available if an employer has received forgiveness of a Paycheck Protection Program (PPP) loan. This limitation prevents double-dipping and ensures that businesses are not benefitting from multiple relief programs for the same expenses.

The Employee Retention Credit program is designed to incentivize employers to retain and hire employees during these challenging times. By providing a tax credit, it offers financial relief to businesses and helps to keep the workforce intact. However, it's essential for employers to understand and follow the limitations and timeframes set forth by the program, to ensure compliance and maximize the benefits of the credit.