When bringing on a new employee, whether for payroll or for contracting purposes, there are crucial paperwork and documentation processes that need to be thoroughly understood. This holds particularly true for individuals hired under a 1099 contract, which involves an independent contractor agreement.

One of the main differences between hiring a W-2 employee and a 1099 contractor is the way taxes and benefits are handled. While employees typically have taxes withheld from their wages and are eligible for various employee benefits, such as healthcare and retirement plans, 1099 contractors are responsible for their own taxes and generally do not receive the same benefits.

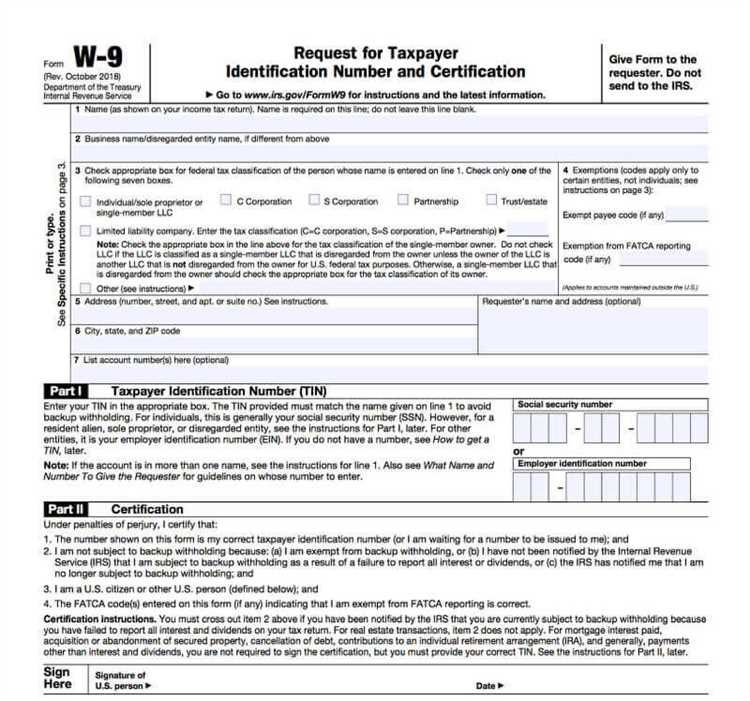

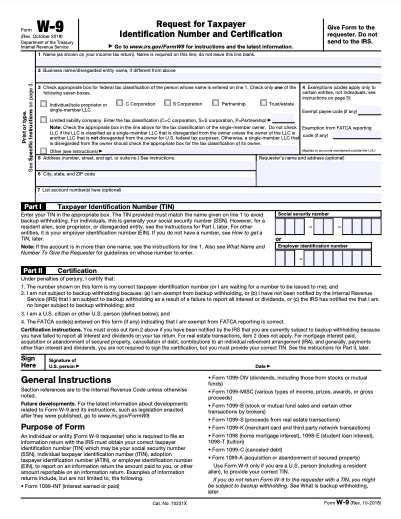

During the onboarding process of a new 1099 hire, it is important for employers to provide the necessary paperwork and forms for proper verification and recordkeeping. This typically includes the completion of a W-9 form, which collects the contractor's taxpayer identification number and other essential information.

Furthermore, employers may also need to collect additional documentation, such as proof of liability insurance coverage or licenses, depending on the nature of the work being performed. This documentation is not only essential for ensuring compliance with legal requirements, but it may also be needed for future audits or tax purposes.

Key Takeaways:

- When hiring a 1099 contractor, it is crucial to understand the unique paperwork and documentation processes involved.

- Unlike W-2 employees, independent contractors are responsible for their own taxes and generally do not receive the same benefits.

- During the onboarding process, employers must collect important documents such as the completed W-9 form and any additional documentation specific to the job being performed.

- These documents are not only necessary for verification and recordkeeping, but they may also be required for future audits or tax purposes.

By understanding and properly handling the new hire paperwork for 1099 employees, employers can ensure compliance with legal requirements, maintain accurate records, and effectively manage their tax obligations. It is essential to familiarize oneself with the specific guidelines and regulations that apply to hiring and working with independent contractors under a 1099 contract.

Understanding New Hire Paperwork for 1099 Employees

When hiring a new employee for a 1099 classification, it is important to understand the necessary paperwork and guidelines to ensure compliance with tax and employment laws. The onboarding process for independent contractors differs from that of regular employees, with specific forms and documents that need to be completed.

One crucial aspect of new hire paperwork for 1099 employees is the contract or agreement that outlines the terms of the working relationship. This document establishes the scope of work, payment terms, and other important details. It is important to have a well-drafted contract that clearly defines the rights and responsibilities of both parties.

In addition to the contract, there are various tax forms that need to be completed for 1099 employees. These include the W-9 form, which collects the employee's taxpayer identification number, as well as other information necessary for reporting wages and taxes. The 1099 forms are used at the end of the year to report income earned by the employee.

Another important aspect of new hire paperwork is recordkeeping. It is important to maintain accurate and detailed records of wages paid to 1099 employees, as well as any tax withholding or deductions. These records may be subject to audit, so it is crucial to keep them organized and easily accessible.

While 1099 employees do not receive traditional employee benefits or participate in payroll deductions, it is still important to provide them with information regarding relevant benefits that are available to them through other means. This may include providing information on health insurance, retirement savings plans, or other options that the employee may choose to pursue independently.

Overall, understanding the necessary paperwork and guidelines for hiring 1099 employees is crucial for compliance with tax and employment laws. By properly completing the required forms and maintaining accurate records, employers can ensure that they are meeting their obligations and avoiding any potential penalties or legal issues.

Overview of 1099 Employment

In the realm of payroll and employment, the term "1099" refers to a specific tax form used to report income earned by independent contractors. Unlike traditional employees, 1099 workers are not considered employees for tax purposes. Instead, they are classified as independent contractors, meaning they are responsible for managing their own taxes and benefits.

When a new hire begins working as a 1099 employee, there are several important documents and paperwork that need to be completed. This process is often referred to as onboarding or orientation. The purpose of this paperwork is to verify the worker's tax classification and ensure compliance with tax laws and regulations.

Some of the key elements involved in 1099 employee paperwork include the completion of a contract or agreement between the employer and the independent contractor, verification of the contractor's tax identification number, recordkeeping of wages and hours worked, and the provision of necessary tax forms, such as the 1099 form, at the end of the year.

It is crucial for employers to accurately classify their workers as either employees or independent contractors. Misclassifying workers can result in serious consequences, including costly audits and penalties. Therefore, employers must thoroughly understand the guidelines for determining worker classification and ensure compliance with applicable laws and regulations.

In summary, 1099 employment involves the hiring and management of independent contractors who are responsible for their own taxes and benefits. Proper completion of the necessary paperwork, careful recordkeeping, and adherence to tax laws and regulations are essential for both employers and 1099 employees. By understanding and following these guidelines, employers can navigate the complexities of 1099 employment and ensure a smooth and compliant working relationship with independent contractors.

What is a 1099 employee?

A 1099 employee, also known as an independent contractor, is a worker who is self-employed and receives compensation on a project or contract basis. Unlike traditional employees, 1099 workers are not on the company's payroll and are not classified as employees for tax purposes. Instead, they are responsible for reporting their own wages and paying their own taxes.

When a company hires a 1099 employee, they are not required to provide the same level of paperwork and documentation as they would for a regular employee. Unlike new employees going through an onboarding process, 1099 workers typically do not need to complete extensive paperwork or attend orientation sessions. Instead, they enter into a contractual agreement with the company and are responsible for keeping their own records of income and expenses.

While 1099 employees are not subject to the same level of oversight and verification as regular employees, it is still important for companies to ensure that their classification is accurate. Misclassifying workers can lead to legal and financial consequences for the company. Therefore, it is important for companies to carefully review the classification of their workers and ensure that they are properly accounted for when it comes to taxes and paperwork.

For 1099 employees, the most important document is the Form 1099-MISC, which is used to report income earned from a company. This form is typically issued by the company to the worker at the end of the year, and the worker is responsible for reporting this income on their tax return. Additionally, 1099 workers should keep careful records of their expenses related to their work, as these expenses may be deductible on their taxes.

In summary, 1099 employees are independent contractors who work on a project or contract basis. They are responsible for their own taxes and paperwork and do not receive the same level of oversight as regular employees. It is important for companies to properly classify their workers and ensure that the necessary documentation and forms are accurately completed and maintained. This will help avoid legal and financial consequences in the event of an audit or review.

Importance of New Hire Paperwork

One of the crucial tasks when onboarding new 1099 employees is completing the necessary paperwork. New hire paperwork plays a significant role in recordkeeping, ensuring compliance with tax and labor laws, and protecting both the employer and the employee.

One important aspect of new hire paperwork is the contract. It outlines the terms and conditions of the employment agreement, including the classification of the employee as an independent contractor. This document helps avoid any misunderstandings and establishes the responsibilities and obligations of both parties.

Another vital component of new hire paperwork is the tax forms. These forms, such as the W-9, ensure that the employer has the necessary information to accurately report wages and fulfill their tax obligations. Additionally, these forms help the employee verify their income and eligibility for certain deductions and benefits.

In addition to tax forms, new hire paperwork may include documents related to benefits. These documents provide information about the available benefits, such as health insurance, retirement plans, and paid time off, allowing the employee to make informed decisions about their coverage and participation.

Completing new hire paperwork is not only important for legal and tax compliance but also for audit purposes. These documents serve as evidence of the hiring process, the classification of the employee, and the wages paid. In the event of an audit, having thorough and accurate new hire paperwork can help protect the employer from penalties and liabilities.

In summary, new hire paperwork is essential for the proper onboarding and management of 1099 employees. It ensures legal and tax compliance, provides necessary information for benefits administration, and protects both the employer and the employee. Employers should prioritize completing and maintaining these documents to avoid any potential issues or disputes in the future.

Legal requirements for new hire paperwork

When bringing on a new hire, whether as an employee or an independent contractor (1099), it is essential to comply with the legal requirements for new hire paperwork. Failing to do so can result in legal consequences, audits, and fines.

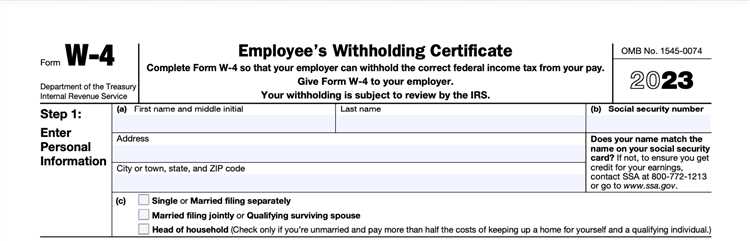

For tax purposes, employers are required to collect certain documents and information from new hires. These documents include the employee's Social Security number or Individual Taxpayer Identification Number, as well as their completed W-4 form. Independent contractors, on the other hand, are required to provide a W-9 form.

Additionally, employers must ensure that they classify their workers correctly as either employees or independent contractors. Misclassifying employees as independent contractors can lead to penalties and legal disputes. The classification of the worker impacts the payroll process, taxes, and benefits eligibility.

During the onboarding process, employers must provide new hires with essential information, such as an employee handbook, workplace policies, and information about benefits and compensation. It is also important to provide the necessary training, orientation, and resources to ensure that the new hire understands their role and responsibilities.

Employers may also need to verify the new hire's eligibility to work in the United States by completing an Employment Eligibility Verification form (Form I-9). This form verifies the identity and employment authorization of individuals hired for employment in the United States.

In conclusion, complying with the legal requirements for new hire paperwork is crucial for employers. By collecting and maintaining the necessary documents, classifying workers correctly, and providing essential information, employers can avoid legal issues, audits, and ensure a smooth onboarding process for their new hires.

Benefits of completing new hire paperwork

Completing new hire paperwork for 1099 employees offers several benefits to both the employer and the employee. These benefits include:

- Tax compliance: New hire paperwork ensures that the necessary tax forms are completed accurately and on time. This helps the employer and the independent employee meet their tax obligations and avoid potential penalties.

- Recordkeeping: The new hire paperwork provides a documented record of the employee's classification, verifying their status as an independent contractor. This recordkeeping helps in case of any audit or verification related to the employee's classification.

- Payroll accuracy: By completing new hire paperwork, the employer can correctly calculate wages and ensure that the independent employee receives accurate and timely payment. This helps maintain a positive working relationship between the parties.

- Orientation: The new hire paperwork serves as a valuable tool during the onboarding process, ensuring that the independent employee understands their rights, responsibilities, and expectations. It provides essential information about benefits, policies, and procedures.

- Legal compliance: Completing new hire paperwork helps employers comply with applicable employment laws and regulations. It ensures that the necessary employment documents, such as contracts and agreements, are in place to protect both parties' interests.

In conclusion, completing new hire paperwork for independent 1099 employees brings several benefits, including tax compliance, recordkeeping, payroll accuracy, orientation, and legal compliance. It is an essential step in establishing a smooth and productive professional relationship between the employer and the independent employee.

Key Documents for 1099 Employees

When onboarding new 1099 employees, there are several key documents that employers must provide to ensure proper recordkeeping and compliance with tax and labor laws. These documents are essential for maintaining a clear understanding of the employee's classification as an independent contractor and their responsibilities in terms of wages, payroll, taxes, and benefits.

1. Contract: The employment contract is a crucial document that outlines the terms and conditions of the working relationship between the employer and the 1099 employee. It includes details such as payment terms, project scope, duration, and confidentiality agreements.

2. New Hire Paperwork: Similar to traditional employees, new 1099 hires must also complete certain paperwork during the onboarding process. This may include a W-9 form to verify tax identification, an I-9 form for employment eligibility verification, and any state-specific tax forms.

3. Payroll Records: Employers must maintain accurate payroll records for 1099 employees, including documentation of wages, hours worked, and any deductions or reimbursements. These records are crucial for auditing purposes and ensuring IRS compliance.

4. Tax Forms: As independent contractors, 1099 employees are responsible for filing their own taxes. However, employers may provide certain tax forms, such as 1099-MISC, which reports the employee's earnings for the tax year. This form is crucial for 1099 employees when filing their annual tax returns.

5. Orientation Materials: Orientation materials can help familiarize new 1099 hires with the company's policies, procedures, and expectations. This may include employee handbooks, safety guidelines, code of conduct, and any relevant training materials.

6. Benefits Information: While 1099 employees are typically not eligible for traditional employee benefits, employers may still provide information on alternative options, such as health savings accounts or retirement plans. This ensures that 1099 employees are aware of potential benefits they can explore on their own.

By ensuring that these key documents are provided to 1099 employees during the onboarding process, employers can establish clear expectations and maintain legal compliance. Effective recordkeeping and proper classification of independent contractors can also help protect against future audits and potential penalties.

Form W-9

The Form W-9 is an essential document for employers when hiring independent contractors, also known as 1099 employees. This form is used to gather important information about the contractor for tax and recordkeeping purposes.

When a new hire is onboarded as an independent contractor, they are required to complete the Form W-9, which includes providing their name, address, and taxpayer identification number (TIN), such as a Social Security Number (SSN) or an Employer Identification Number (EIN).

The purpose of the Form W-9 is to ensure that the employer has the necessary information to accurately report the contractor's wages and complete the required tax forms, such as the 1099-MISC. This form also serves as verification of the contractor's independent classification, as opposed to being an employee.

Employers are responsible for keeping the completed Form W-9 on file for at least four years, as it may be subject to audit by tax authorities. This document is important not only for tax purposes but also for ensuring compliance with labor laws and regulations regarding the classification of workers.

By collecting the Form W-9 during the onboarding process, employers can accurately report contractors' wages, provide necessary tax documentation, and avoid potential penalties or audits related to misclassification of workers. It is a critical part of the paperwork and recordkeeping process for hiring new 1099 employees.

Independent contractor agreement

In the context of hiring and classifying workers, an independent contractor agreement is a crucial document that signifies the nature of the relationship between the payer, who is usually the employer, and the payee, who is an independent contractor. This agreement outlines the terms and conditions of the working arrangement, ensuring that both parties are aware of their responsibilities and obligations.

The independent contractor agreement typically covers various aspects, including payroll and wages. It specifies how the contractor will be compensated for their services and the frequency of payment. Additionally, the agreement may address recordkeeping requirements to ensure accurate and transparent financial documentation.

In terms of taxation, the independent contractor agreement clarifies that the contractor is not an employee, but rather an independent entity responsible for their own taxes. This ensures that the employer is not liable for withholding taxes or providing employee benefits. As a result, the independent contractor is responsible for paying their own taxes and managing their benefits independently.

During the onboarding process, new hires must carefully review and sign the independent contractor agreement. This helps to establish a clear understanding of the working relationship and avoids potential misunderstandings or misclassifications. The agreement also serves as a verification document in case of an audit or legal dispute, providing evidence of the intended independent contractor status.

It is crucial for both employers and independent contractors to familiarize themselves with the necessary paperwork and forms associated with the 1099 employment classification. These may include tax forms such as the W-9, and other documents required for reporting income and expenses. Maintaining accurate and organized records is essential to comply with tax regulations and ensure a smooth audit process if necessary.

In summary, the independent contractor agreement is a vital component of the onboarding process for new 1099 employees. It establishes the terms of the working relationship, clarifies responsibilities regarding taxes and benefits, and supports accurate recordkeeping. By understanding and adhering to the provisions of the independent contractor agreement, both employers and independent contractors can mitigate legal and financial risks and foster a successful working relationship.

Mandatory New Hire Paperwork

When bringing on a new hire, whether they are an independent contractor or an employee, there is certain paperwork that is required to be completed. This paperwork serves various purposes such as ensuring proper payroll and recordkeeping, verifying the worker's tax classification, and fulfilling legal and tax obligations.

For employees, the mandatory new hire paperwork typically includes forms such as a W-4 form for tax withholding, an I-9 form for employment eligibility verification, and an employment contract that outlines the terms and conditions of the job. These forms are essential for the employer to accurately withhold and report the employee's wages and benefits, as well as comply with labor laws and regulations.

On the other hand, independent contractors, who are classified differently for tax purposes, may need to complete different forms such as a Form W-9, which provides the employer with the contractor's taxpayer identification number and other relevant information. This form is necessary for the employer to report the contractor's earnings and issue a 1099 form at the end of the year for tax reporting purposes.

In addition to these important tax forms, there may be other documents that need to be completed during the new hire onboarding process, such as confidentiality agreements, non-compete agreements, or direct deposit authorization forms. These additional documents ensure the protection of sensitive information, define the terms of employment, and facilitate the payment of wages.

It is crucial for employers to maintain proper recordkeeping of all the completed new hire paperwork. These documents may be required during tax audits or in case of any legal disputes or labor investigations. Employers should keep the paperwork in a safe and accessible location, following the relevant retention requirements for each type of document.

To ensure compliance and avoid potential penalties, employers should thoroughly understand the mandatory new hire paperwork requirements for both employees and independent contractors. By providing the necessary forms and collecting the required information, employers can establish a solid foundation for proper payroll, tax reporting, and employee documentation from the very beginning of the working relationship.

Form I-9

The Form I-9, Employment Eligibility Verification, is an essential document in the hiring process for both employers and employees. This form is used to verify the identity and employment authorization of individuals hired for employment in the United States.

Form I-9 requires the employee to provide specific information and documents to establish their identity and work eligibility. It has different sections to be completed by the employee and the employer. The employee needs to fill out section 1 of the form, which includes personal information, contact details, and the employee's classification.

The employer is responsible for completing section 2 of the Form I-9. This section requires the employer to physically examine the employee's documents provided as proof of identity and eligibility to work. The employer must verify that the documents appear to be genuine and relate to the employee.

Employers must keep the Form I-9 on file for each employee for a specified period to comply with recordkeeping requirements. The form may be requested for inspection during audits by the U.S. Immigration and Customs Enforcement (ICE) to ensure compliance with employment eligibility verification laws.

Proper completion and retention of Form I-9 is crucial to ensure compliance with federal regulations and to avoid penalties for non-compliance. Employers should familiarize themselves with the requirements and guidelines for completing and storing these forms to facilitate a smooth onboarding process for new hires.

State-specific forms

When hiring a new 1099 employee, it's important to be aware of the state-specific forms that may be required for tax and recordkeeping purposes. Each state has its own set of documents that employers must comply with when onboarding new employees.

These state-specific forms cover various aspects of an employee's wages, payroll taxes, classification verification, and other important information. Failure to properly complete and submit these forms can result in penalties during a tax audit.

Some of the common state-specific forms include:

- State W-4: Similar to the federal W-4, this form is used to determine the amount of state income tax that should be withheld from an employee's wages.

- New Hire Reporting: Many states require employers to report new hires to the appropriate state agency within a certain timeframe. This helps in the enforcement of child support orders and prevents fraud.

- State Unemployment Insurance: Employers may need to register for state unemployment insurance and provide necessary employee information, such as wages and payroll taxes.

Other state-specific forms could include orientation documents, benefit enrollment forms, and worker's compensation forms. It's crucial to research and understand the requirements of each state where your business operates to ensure compliance with all applicable laws and regulations.

Having a thorough understanding of state-specific forms is essential to effectively manage the paperwork associated with hiring and onboarding new 1099 employees. By staying up-to-date with these forms and their requirements, employers can maintain proper recordkeeping, fulfill tax obligations, and avoid legal complications related to misclassification of employees.

Optional New Hire Paperwork

When hiring new employees classified as 1099 contractors, there are certain essential documents that must be completed. However, there may also be optional paperwork that employers can provide to these new hires to ensure proper recordkeeping and compliance with tax regulations.

One optional document is a contract or agreement outlining the terms and conditions of the working relationship. This document can clarify the expectations between the employer and the contractor and ensure that both parties are on the same page regarding responsibilities and compensation.

Another optional form is an orientation packet or handbook. This can provide new hires with important information about company policies, procedures, and benefits. It can also outline the payroll process, such as how wages will be paid and when to expect payments.

In addition, employers may choose to provide tax forms that can help the contractor with their tax obligations. These forms could include a W-9 form for tax identification and verification, as well as information on how to report income and any applicable deductions. This can assist independent contractors in properly calculating and paying their taxes.

Overall, while not required by law, providing optional new hire paperwork can be beneficial for both the employer and the employee. It can help establish clear expectations, provide important information, and ensure proper recordkeeping and compliance with tax regulations.

Direct deposit authorization form

When hiring a new 1099 employee, it is important to have all the necessary paperwork in place to ensure compliance with tax and payroll regulations. One crucial document that should be completed during the onboarding process is the direct deposit authorization form.

The direct deposit authorization form allows the employee to provide their banking information so that wages can be deposited directly into their account. This not only saves time and resources in terms of issuing paper checks, but it also provides a convenient and secure way for the employee to access their earnings.

In addition to facilitating the payment of wages, the direct deposit authorization form also plays a role in recordkeeping and tax classification. By collecting the employee's bank account details, the employer can maintain accurate records for auditing purposes and ensure proper tax reporting.

Furthermore, the direct deposit authorization form helps to establish the independent contractor status of the 1099 employee. As part of the hiring process, it is important to correctly classify workers to comply with labor laws and avoid costly penalties. By having the employee fill out this form, the employer can verify that the individual is truly an independent contractor.

It is essential for employers to keep completed direct deposit authorization forms on file, along with other necessary paperwork such as the contract agreement, tax forms, and benefits forms. These documents serve as a record of the employer-employee relationship and should be easily accessible for reference or future audits. Overall, the direct deposit authorization form is a critical component of the new hire paperwork for 1099 employees, ensuring efficient payroll processing, accurate tax classification, and proper recordkeeping.

Non-disclosure agreement

A non-disclosure agreement (NDA), also known as a confidentiality agreement, is a legal contract between an employer and an independent contractor (1099 employee) that outlines the terms and conditions regarding the protection of confidential information.

Classified as a vital document during the onboarding process, the non-disclosure agreement ensures that the new hire understands their responsibilities in safeguarding sensitive information related to the employer's business operations.

This crucial paperwork helps protect the employer's intellectual property, trade secrets, financial data, and client information by setting clear guidelines for the independent contractor's use and disclosure of such information.

The non-disclosure agreement should be carefully reviewed by both the employer and the new hire to ensure mutual understanding and agreement. It covers various aspects, including the scope of confidentiality, exclusions, non-compete clauses (if applicable), and the duration of the agreement.

- The classification of the information that needs to be kept confidential should be clearly defined, ensuring that the independent contractor understands which material is considered sensitive.

- The non-disclosure agreement also provides guidelines on how the confidential information must be handled, stored, and protected, including requirements for secure recordkeeping and verification processes.

- This document may also address the consequences of breaching the agreement, such as potential legal actions and monetary penalties that the independent contractor might face in the event of unauthorized disclosure or use of confidential information.

It is essential for both employers and independent contractors to keep a copy of the signed non-disclosure agreement in their records as it may be required during audits or legal disputes. The NDA should be kept confidential and not shared with any third parties unless required by law or with written consent from both parties.

By having an enforceable non-disclosure agreement in place, employers can have peace of mind knowing that their confidential information is protected, and independent contractors can understand their obligations regarding the handling of sensitive data.

Best Practices for Completing New Hire Paperwork

When it comes to completing new hire paperwork for 1099 employees, there are several best practices that can ensure a smooth onboarding process and help meet legal requirements. These practices cover various aspects, including document verification, tax classification, recordkeeping, and contract management.

1. Thoroughly review and complete all necessary forms: Prior to the employee's first day, ensure that all required paperwork is ready and accessible. This includes forms such as the W-9, I-9, and any state-specific tax forms. Thoroughly review each form to ensure accuracy and completion.

2. Verify employee identification and eligibility: As part of the onboarding process, be diligent in verifying the employee's identification and eligibility to work in the country. This includes obtaining proper identification documents, such as a valid driver's license or passport, and completing the I-9 form.

3. Clearly establish tax classification: It is crucial to accurately classify the employee's tax status to avoid potential audit issues in the future. Determine whether the individual is an independent contractor or an employee based on the IRS guidelines and provide the appropriate tax forms accordingly.

4. Provide clear information on wages and benefits: Clearly communicate the employee's wage rate, frequency of payment, and any applicable benefits. This ensures transparency and helps avoid future disputes or confusion regarding compensation.

5. Maintain proper recordkeeping: Keep a well-organized system for storing and maintaining all employee paperwork and records. This includes not only the completed forms, but also any other relevant documents, such as contracts or agreements. Proper recordkeeping is essential for compliance and potential audits.

6. Conduct a thorough orientation: In addition to completing paperwork, provide the employee with a comprehensive orientation on company policies, procedures, and expectations. This will help them understand their role and responsibilities, fostering a positive and productive work environment.

7. Seek legal guidance if necessary: If you have any doubts or uncertainties about the new hire paperwork or the proper classification of an employee, it is always advisable to seek legal guidance. Consulting with an employment attorney or a tax professional can help ensure compliance with all applicable laws and regulations.

Following these best practices for completing new hire paperwork can help streamline the onboarding process, ensure legal compliance, and set the stage for a successful working relationship with your 1099 employee.

Reviewing documents with new hires

When onboarding new hires for 1099 employment, it is important to thoroughly review and explain all relevant documents to ensure compliance and smooth operations. This includes the contract, which outlines the terms and conditions of the working relationship and confirms the independent contractor classification.

Aside from the contract, it is crucial to go over the verification documents such as identification cards, Social Security numbers, and other required information. This ensures accuracy in payroll processing and tax withholding.

New hires should also be briefed on the necessary recordkeeping practices they must follow. This includes keeping track of hours worked, wages earned, and tax deductions. Encourage them to maintain organized paperwork and provide guidance on filling out any required forms.

During this review process, it is vital to address the differences between 1099 employees and traditional employees. Explain that as independent contractors, they are responsible for paying their own taxes, including self-employment taxes. Provide resources or guidance on how to calculate and budget for these taxes.

Additionally, discuss any benefits or perks that may be available to them as independent contractors, such as the ability to deduct certain business expenses. Make sure they understand the importance of keeping receipts and maintaining accurate records for tax purposes.

In conclusion, reviewing and explaining all necessary documents with new hires is a critical step in the onboarding process for 1099 employees. It ensures that they are aware of their rights, responsibilities, and obligations, while helping to minimize potential issues during tax audits or employee classification audits.

Keeping records and organizing paperwork

When hiring new employees, it is vital for employers to stay organized and maintain proper recordkeeping. This includes keeping track of various forms, such as the 1099 classification documents, as well as other paperwork related to orientation, contract agreements, and independent verification.

Employers should ensure that all necessary forms are completed and accurately filled out by the new hire. This includes the completion of tax forms, which are crucial for determining appropriate tax withholding and ensuring compliance with federal and state regulations. This paperwork should be kept securely and readily accessible in case of an audit or other legal requirements.

Aside from the tax-related paperwork, employers must also keep records of other important documents, such as proof of eligibility to work in the country, verification of identity, and any relevant certifications or licenses. This documentation is essential for maintaining compliance with immigration laws and ensuring the legitimacy of the new hire's employment status.

Furthermore, employers should also keep track of all employee compensation records, including wages, bonuses, and benefits. These records are not only required for accurate payroll processing but also serve as a reference for any future discussions regarding compensation or disputes that may arise.

It is recommended for employers to establish an organized system for recordkeeping, such as maintaining a digital or physical folder for each employee, labeled with their name and the necessary documentation. Implementing a consistent method for organizing paperwork can help employers easily locate and access important information when needed.

In conclusion, maintaining proper recordkeeping and organizing paperwork is crucial for employers when onboarding new 1099 employees. Staying organized and keeping track of all necessary forms, tax documents, and employee records is essential for ensuring compliance with legal requirements, facilitating smooth payroll processing, and resolving any potential disputes or audits effectively.

Consequences of Incomplete or Incorrect Paperwork

Failing to properly complete or submit the necessary paperwork for new hires can have significant consequences for employers, particularly when it comes to taxes and legal compliance.

One major consequence of incomplete or incorrect paperwork is the misclassification of employees. If the required forms and documents are not properly filled out, an employer may unintentionally classify a worker as an independent contractor (1099) instead of an employee (W-2). This can lead to legal and financial complications, as misclassification can result in fines, penalties, and back taxes.

Another consequence of incomplete or incorrect paperwork is the potential for failing to meet government reporting requirements. Employers may be required to file certain forms, such as Form 1099, to report payments made to independent contractors or other non-employees. Failing to file these forms or filing them incorrectly can result in penalties and audits by tax authorities.

In addition to tax implications, incomplete or incorrect paperwork can also impact an employee's benefits and rights. For example, if an employee's paperwork is not properly completed, they may not be eligible for certain benefits, such as health insurance or retirement plans. This can lead to dissatisfaction and potential legal issues for the employer.

Furthermore, incomplete or incorrect paperwork can create challenges in recordkeeping and payroll management. Without accurate and complete information, employers may struggle to accurately calculate and report wages, deductions, and withholdings. This can lead to errors in payroll processing and potentially result in disputes with employees over wages or tax withholdings.

To avoid these consequences, it is essential for employers to have a thorough onboarding process that includes comprehensive orientation and guidance on completing the necessary paperwork. Regular audits and reviews of employee records and paperwork can also help ensure compliance and minimize potential risks.

Legal penalties for non-compliance

When it comes to new hire paperwork for 1099 employees, there are legal requirements that must be followed to avoid serious penalties. Failure to comply with these requirements can result in audits, fines, and legal consequences.

One of the key areas of compliance is recordkeeping. Employers are required to maintain accurate records of wages, tax forms, and any other documentation related to the independent contractor's classification and employment status. Failure to keep proper records can not only result in fines but can also make it difficult to defend against claims of misclassification.

Another area of compliance is tax reporting. Employers must ensure that all necessary tax forms are completed and submitted accurately and on time. This includes providing the independent contractor with the appropriate tax documents, such as Form 1099, and reporting their wages to the IRS. Failure to do so can result in penalties for both the employer and the employee.

Verification of independent contractor status is also crucial. Employers must have proper documentation and evidence to support the classification of a worker as an independent contractor. This can include signed contracts, invoices, or any other relevant paperwork. Failure to verify the independent contractor status can lead to additional taxes, penalties, and potential legal disputes.

In addition to the financial penalties, non-compliance can also have negative consequences for the employer's reputation and relationships with clients and contractors. It is essential for employers to prioritize compliance with new hire paperwork requirements to avoid the legal, financial, and reputational risks associated with non-compliance.

Implications for tax and benefits

The classification of an employee as a 1099 contractor has important implications for tax and benefits. As an independent contractor, the individual is responsible for their own taxes and must file a 1099 form with the IRS to report their income. This means that the employer is not responsible for withholding taxes from their wages or providing benefits such as health insurance or retirement plans.

However, it is important for employers to ensure that the classification of a new hire as a 1099 contractor is accurate and meets the legal requirements. Misclassifying an employee as an independent contractor can result in audits and penalties from tax authorities.

During the onboarding and orientation process, employers should request 1099 contractors to provide necessary documents for verification, such as their business license or certification, proof of liability insurance, and a contract outlining the terms of their engagement. It is crucial to keep thorough recordkeeping to demonstrate that the hire is a legitimate independent contractor and not an employee.

While 1099 contractors may not receive benefits from the employer, they have the freedom to negotiate their own rates and choose their clients. They are also able to deduct business expenses from their taxes, such as travel and equipment costs, which can help offset the lack of traditional benefits.

Employers should also be aware of the implications of misclassification. If an individual is found to be misclassified as a 1099 contractor when they should have been classified as an employee, the employer may be required to provide retroactive benefits, pay back taxes, and potentially face legal consequences.

Resources for New Hire Paperwork

When hiring independent contractors, also known as 1099 employees, it's crucial to have the appropriate paperwork in order to comply with tax and payroll regulations. Here are some essential resources to help you navigate this process:

- Tax Forms: The Internal Revenue Service (IRS) provides a range of tax forms that are essential for hiring and paying 1099 employees. These forms include the W-9, which is used to collect the contractor's tax identification information, and the 1099-MISC, which is used to report the contractor's wages to the IRS.

- Onboarding Documents: As part of the onboarding process, you will need to have certain documents on hand for new hires. This may include an independent contractor agreement, which outlines the terms of the contractor's engagement, and any necessary background check or verification forms.

- Recordkeeping: Keeping accurate records is crucial when it comes to hiring and paying contractors. This includes documenting any changes to pay rates, hours worked, or project details. It's important to establish a system for recordkeeping and organization to ensure compliance and easy retrieval of information if it's needed for an audit.

- Classification Guidelines: Understanding the proper classification of workers is essential to avoid potential misclassification issues. The IRS provides guidelines and resources to help determine whether a worker should be classified as an employee or an independent contractor. Familiarize yourself with these guidelines to ensure proper classification.

- Employee Benefits: Unlike traditional employees, 1099 contractors are not eligible for the same benefits such as health insurance or retirement plans. However, you may choose to offer other types of benefits, such as flexible work arrangements or bonuses, to attract and retain contractors. Be sure to clearly communicate the benefits package to new hires.

Government websites and forms

When it comes to understanding the new hire paperwork for 1099 employees, it is essential to be familiar with the various government websites and forms that are relevant to this process. These resources provide important information and guidelines for both employers and employees.

One of the primary government websites that employers should utilize is the Internal Revenue Service (IRS) website. The IRS provides extensive information on the classification of workers, including the distinction between independent contractors and employees. This website also offers forms such as Form W-9, which is used to request employee identification and taxpayer information, and Form 1099-MISC, which is used to report wages paid to independent contractors.

In addition to the IRS, employers should also visit the website of the U.S. Department of Labor (DOL). The DOL provides valuable resources on topics such as onboarding and orientation processes for new hires, including the necessary paperwork and recordkeeping requirements. Employers can find information on verifying employment eligibility through Form I-9, as well as guidelines for properly classifying workers.

Furthermore, state-specific government websites can also be helpful when it comes to new hire paperwork for 1099 employees. Many states have their own forms and regulations in addition to the federal requirements. Employers should refer to these websites to ensure compliance with state laws regarding wages, benefits, and payroll.

Overall, familiarizing oneself with government websites and forms is crucial for understanding the necessary paperwork and guidelines for hiring and classifying 1099 employees. Employers must stay up to date with the latest information and requirements to avoid potential audits and penalties related to tax and worker classification.

Hiring software and platforms

When it comes to hiring new 1099 employees, utilizing software and platforms can greatly streamline the process. These tools can help employers manage the necessary paperwork and documentation required for onboarding independent contractors.

One key feature of hiring software is its ability to generate and store essential forms and documents. This includes tax forms, such as the W-9 form, which is used to collect the independent contractor's taxpayer identification number. Additionally, platforms can help generate and store employment contracts, ensuring that there is a clear agreement between the employer and the contractor.

Another important aspect of hiring software is its capability to handle wages and payroll. It can calculate the hourly or project-based rates and generate pay stubs or invoices for the contractor. This simplifies the process of accurately tracking and documenting wages, ensuring compliance with applicable regulations.

Furthermore, these platforms can assist with employee verification and classification. They can verify the contractor's credentials, including their background and qualifications, helping employers make informed decisions when hiring. Additionally, they can help classify workers correctly as either employees or independent contractors, reducing the risk of misclassification and potential legal issues.

Moreover, hiring software can facilitate benefits administration for 1099 employees. While independent contractors generally do not receive traditional employee benefits, employers may still offer certain perks or incentives. These platforms can help manage and track any benefits or reimbursements provided to contractors, simplifying the process for both parties.

Finally, hiring software and platforms often offer features to assist with onboarding and orientation. They can provide new contractors with access to necessary paperwork, guidelines, and training materials in a centralized location. This ensures that contractors have all the information they need to begin their work and understand the expectations and procedures of the company.

In summary, utilizing hiring software and platforms can greatly simplify the process of onboarding new 1099 employees. From generating essential forms and documents to handling wages and payroll, these tools help employers effectively manage the paperwork and recordkeeping required for independent contractors. Additionally, they assist with employee verification, classification, benefits administration, and onboarding, creating a seamless and efficient process for both employers and contractors.

Frequently Asked Questions

Q: What is the difference between an employee and an independent contractor?

An employee is an individual who works for a company and is subject to the company's control and direction. They are typically hired for a set period of time and receive benefits such as health insurance and paid time off. On the other hand, an independent contractor is self-employed and works on a contract basis. They have more control over their work and are responsible for their own taxes and benefits.

Q: What paperwork is required when hiring a 1099 contractor?

When hiring a 1099 contractor, certain paperwork needs to be completed. This includes a contract or agreement outlining the terms of the arrangement, a Form W-9 to collect the contractor's tax identification number, and any additional documents required for verification purposes.

Q: How should onboarding paperwork for 1099 contractors be handled?

Orientation and onboarding for 1099 contractors may differ from that of regular employees. While some companies may have a formal onboarding process, others may simply provide the necessary paperwork, such as contracts and tax forms, for the contractor to complete. It is important to keep thorough records of any documents exchanged for recordkeeping and audit purposes.

Q: Do 1099 contractors receive benefits?

Unlike employees, 1099 contractors are not typically eligible for benefits such as health insurance, paid time off, or retirement plans. As independent contractors, they are responsible for providing their own benefits.

Q: How is taxation different for 1099 contractors?

1099 contractors are considered self-employed and are responsible for paying their own taxes. They are required to file quarterly estimated taxes and may be subject to additional self-employment taxes. Unlike employees, they do not have taxes withheld from their paychecks.

Q: What tax forms should be provided to a 1099 contractor?

A 1099 contractor should receive a Form 1099-MISC at the end of the year, which reports the total amount paid to them. Additionally, they may need to provide their own tax forms, such as Schedule C for reporting business income and expenses.

Is new hire paperwork required for all employees?

When it comes to hiring new employees, regardless of their employment classification, certain paperwork and documents are required to ensure compliance with various laws and regulations. For contract workers, also known as 1099 employees or independent contractors, the onboarding process may differ slightly from that of traditional W-2 employees.

While 1099 employees are not considered traditional employees and are responsible for paying their own taxes, they still need to go through the necessary new hire paperwork. This paperwork typically includes completing forms such as the W-9, which provides employers with the employee's information for tax purposes.

In addition to tax-related forms, 1099 employees may also need to provide additional documentation for recordkeeping purposes. This may include contracts or agreements outlining the terms of their services, verification of their eligibility to work in the country, and any necessary licenses or certifications required for their specific role.

Although 1099 employees are not eligible for employee benefits or participation in the company's payroll system, it is still essential to properly document their onboarding process. This paperwork can serve as evidence of the worker's classification in case of an audit or dispute about their employment status. It also helps establish a clear understanding between the company and the contractor regarding the scope of work, payment terms, and other important details.

In summary, while the new hire paperwork process may vary slightly for 1099 employees compared to traditional employees, it is still necessary to collect and keep essential documents and forms. This ensures compliance with tax regulations, recordkeeping requirements, and establishes clear expectations for both parties involved.

What are the consequences of misclassification?

Misclassifying employees as independent contractors can have serious consequences for employers. Here are some of the potential consequences:

- Financial Penalties: Employers can face significant financial penalties if they misclassify employees as independent contractors. The Internal Revenue Service (IRS) can impose fines and back taxes for misclassified employees, which can add up to substantial amounts.

- Lost Benefits: Misclassified employees may not have access to the same benefits as traditional employees. This can include health insurance, retirement plans, and other perks that can significantly impact an individual's overall compensation package.

- Lawsuits and Legal Costs: Misclassified employees may sue employers for denying them benefits and protections that they would have received as traditional employees. This can result in costly legal battles and potential damages for the employer.

- Tax Audits: Misclassifying employees can increase the likelihood of a tax audit. The IRS and state tax authorities are increasingly scrutinizing worker classification to ensure compliance with tax laws. An audit can not only result in financial penalties but also be time-consuming and disruptive to a business.

- Reputational Damage: Misclassification can also damage an employer's reputation. If it becomes known that a company has misclassified workers, it can lead to negative publicity and a loss of trust from employees, customers, and the general public.

Given the potential consequences, it is crucial for employers to properly classify their workers and ensure compliance with applicable laws and regulations.